Why did my universal life premium change?

Every year, some owners of Universal Life policies receive a notice from their insurance company that their policy will cancel if they do not increase their payment. They are concerned because they did not think their payment was ever supposed to increase. However, that isn’t always the case.

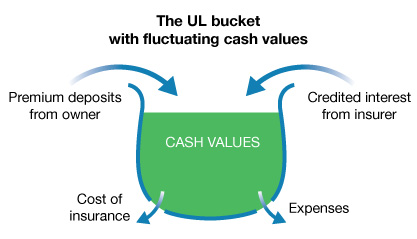

A Flexible Premium Adjustable Life Insurance policy is commonly referred to as a Universal Life policy. A simple way to think of a Universal Life policy is to think of it as a “bucket.” The bucket fills up with money, or cash value, by premium payments you make, and interest credited to you from your insurance company. Money is taken out of the bucket by the cost of insurance and the expense charges of the policy.

As an example, say you start your policy at age 25, and you pay $50 a month, which is dumped into your bucket. Your cost of insurance at age 25 is only $6 per month and the expense charges are $4. So, after the $10 is deducted, $40 stays in your bucket. As you get older, the internal cost of insurance continues to increase, but ideally you are able to pay the same $50 per month, because your bucket filled with cash value pays the difference. Using the same example, you are now 65 years old and pay the same $50 a month, which is dumped into your bucket. The cost of insurance now is $75 per month, and the expense charges are still $4. The additional $29 needed for that month’s payment is taken from the cash value, or the money in the bucket. At this point, the $50 is less than the true cost of insurance causing the policy’s cash value to decrease.

It is common for your insurance company to come up with the monthly premium by estimating what payment would provide coverage to age 100 without depleting the cash value. This premium will never be exact, however, because insurance companies can only make educated predictions on future interest rates, based on history and current data. There are also other factors that could cause the bucket to prematurely run out of money. Examples include not making premium payments for a period of time, withdrawing some of the cash value, taking loans against the policy, or increasing the coverage but not the premium.

The best way to protect your Universal Life policy is to review your annual statement with your agent or insurance company. This way, you can adjust your premium by small amounts along the way if needed, and avoid your policy being in danger of cancellation or in need of a large sum of money.

If you have questions or concerns about your Universal Life policy, you can reach a consumer advocate at 1-888-877-4894 (toll-free) or at

DFR.InsuranceHelp@oregon.gov.